How Reading About Finance and Wealth Builds a Money-Smart Mindset

Introduction

Money doesn’t just grow in your bank account — it grows in your mind.

Reading about finance and wealth teaches you how money works, how to manage it, and how to make it grow.

A financial education through books cultivates smart habits, informed decisions, and a mindset focused on abundance rather than scarcity.

Here’s why financial reading is essential for anyone who wants to achieve lasting wealth.

1. Builds Financial Literacy

Finance books teach budgeting, investing, and money management strategies.

Understanding these concepts early prevents costly mistakes and creates a foundation for long-term financial stability.

2. Develops a Wealth Mindset

Reading stories of entrepreneurs, investors, and self-made individuals shifts your perspective on money.

You start to think strategically, spot opportunities, and believe that wealth is achievable with discipline and knowledge.

3. Encourages Smart Decision-Making

Books provide frameworks for evaluating risks, making investments, and managing expenses.

By learning from experts’ experiences, you can make informed choices instead of reacting impulsively.

4. Inspires Goal-Oriented Financial Habits

Reading about finance motivates you to set goals, track progress, and take actionable steps toward wealth creation.

It reinforces the habit of planning, saving, and growing assets systematically.

5. Enhances Long-Term Planning Skills

Financial books often emphasize foresight, retirement planning, and strategic growth.

You learn to think beyond immediate gains, focusing on sustainable wealth and future security.

Conclusion

Your financial future starts with your knowledge today.

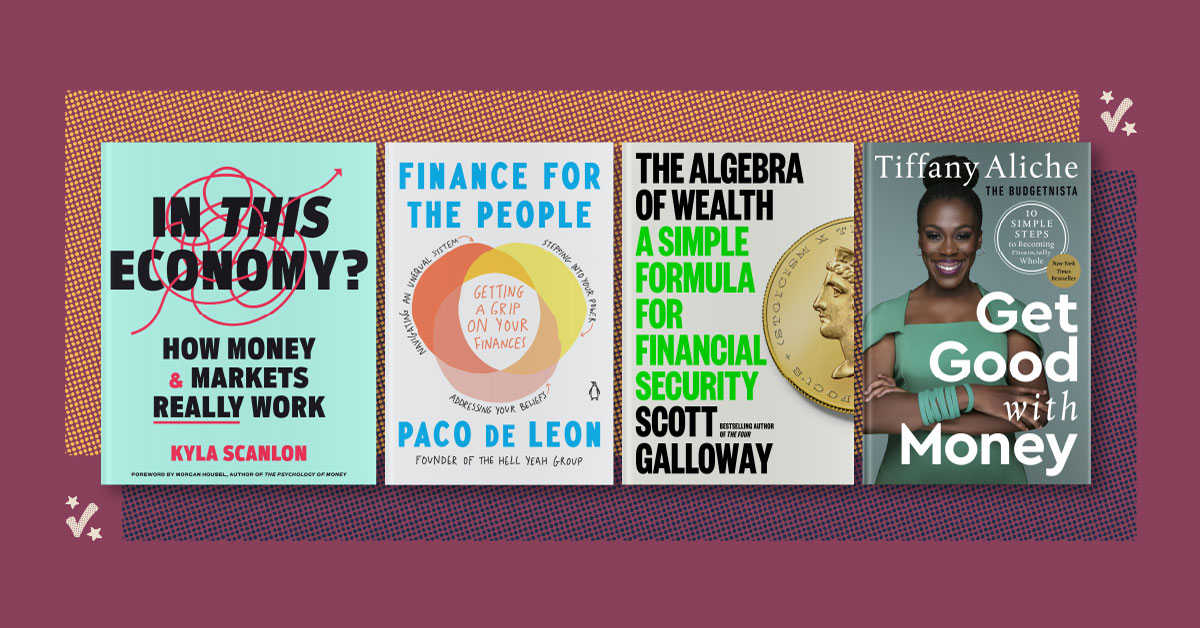

Pick up books about finance, investing, and wealth mindset, and let the lessons guide your decisions.

Because a money-smart mind creates money-smart actions, turning knowledge into lasting financial success.